Navigating the Complexities of Demand Planning and Fulfillment

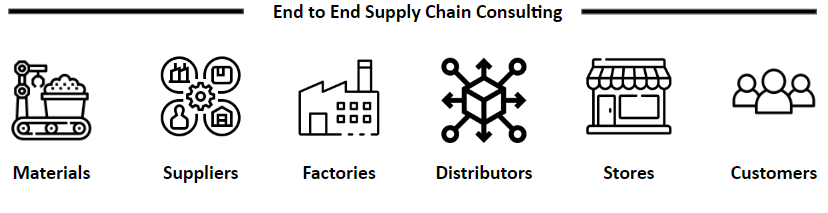

In today’s complex business world, demand planning and fulfillment are critical components of supply chain management. However, many companies struggle to meet customer demand while maintaining optimal inventory levels and minimizing costs. This is where demand planning and fulfillment consulting experts can help.

What is Demand Planning and Fulfillment?

Demand planning is the process of forecasting customer demand for products and services. It involves analyzing historical data, market trends, and other factors to estimate future demand. Accurate demand planning is essential to ensure that the right products are available at the right time and in the right quantities.

Fulfillment, on the other hand, is the process of delivering products and services to customers. It includes order processing, inventory management, and shipping. Efficient and effective fulfillment is crucial for customer satisfaction and retention.

Why Hire Demand Planning and Fulfillment Consulting Experts?

Demand planning and fulfillment can be complex, involving many different factors that can impact supply chain efficiency. Consulting experts can provide the guidance and expertise needed to navigate these complexities and optimize your supply chain operations.

Here are some of the benefits of hiring demand planning and fulfillment consulting experts:

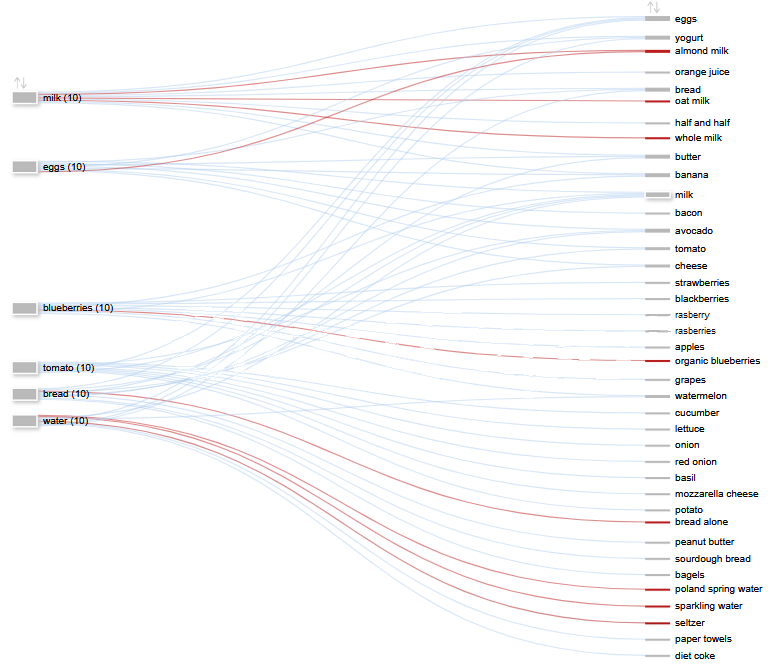

- Improved Forecast Accuracy: Consulting experts can help you develop more accurate demand forecasts by analyzing historical data, market trends, and other factors. This can lead to better inventory management and improved customer service levels.

- Inventory Optimization: Consulting experts can help you optimize your inventory levels to minimize costs while ensuring that the right products are available when and where they are needed.

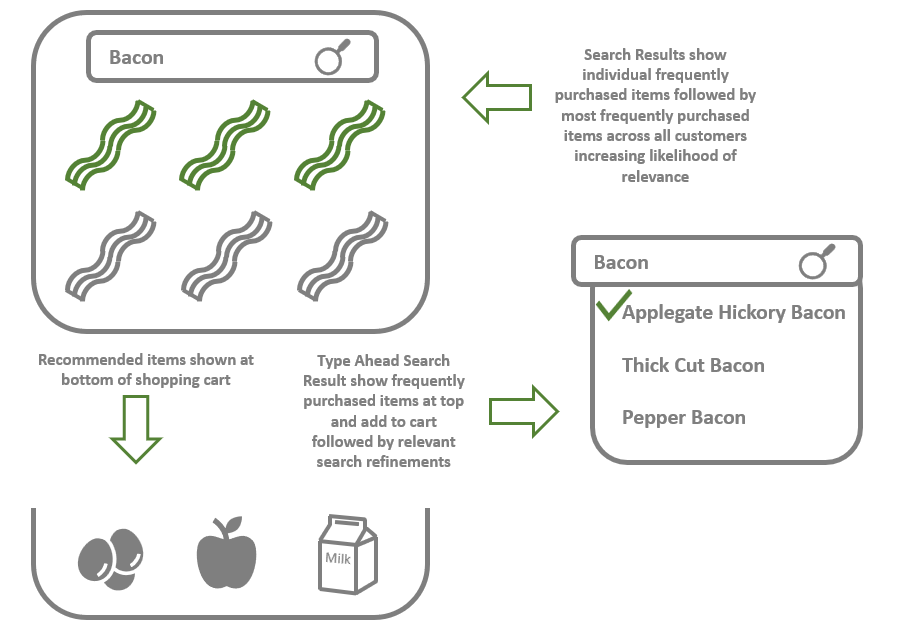

- Improved Order Processing: Consulting experts can help you streamline your order processing and fulfillment operations, reducing errors and improving customer satisfaction.

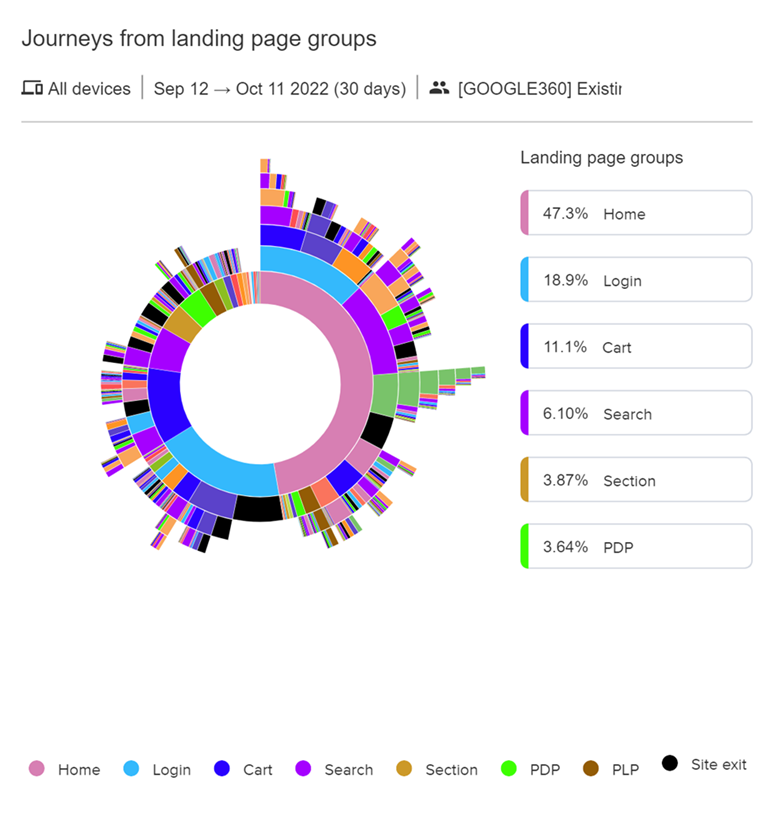

- Supply Chain Visibility: Consulting experts can help you gain visibility into your supply chain operations, allowing you to identify and address bottlenecks and other inefficiencies.

- Scalability: Consulting experts can help you scale your operations to meet changing demand, ensuring that you can continue to meet customer needs as your business grows.

Our experts can provide valuable guidance and support across industries. Whether you need help with forecasting, inventory management, order processing, or supply chain visibility, our consultants can help you optimize your operations and improve customer satisfaction.