Integrating S&OP with Financial Planning

A Roadmap to Align Operational and Financial Goals

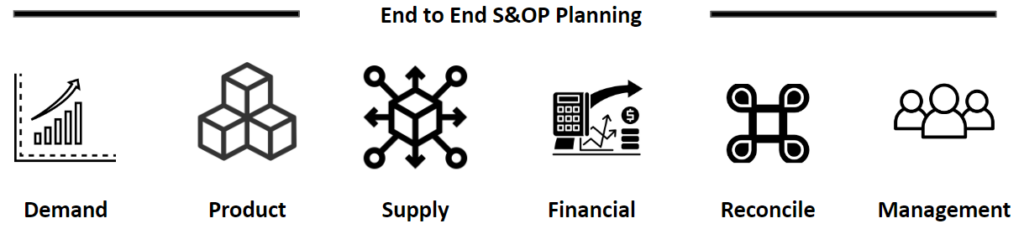

Aligning operational activities with financial objectives is more critical than ever. Sales and Operations Planning (S&OP) is a vital process that helps organizations synchronize their supply and demand planning. However, without a strong link to financial planning, S&OP can fall short of delivering the expected business results. Integrating S&OP with financial planning ensures that every operational plan directly supports the organization’s financial goals, enhancing agility, profitability, and overall business performance.

1. The Importance of Financial Alignment in S&OP

Financial alignment is the cornerstone of effective S&OP. When S&OP processes are aligned with financial planning, they ensure that all operational activities are geared towards achieving revenue targets and maintaining cost controls. This alignment reduces the risk of discrepancies between what the operations team is executing and what the finance team is forecasting.

Misalignment between S&OP and financial planning can lead to serious consequences, such as financial underperformance, missed revenue opportunities, and inflated costs. For instance, if production schedules are planned without considering financial forecasts, the company may end up overproducing inventory that ties up capital and increases holding costs. Conversely, underproduction can result in stockouts, lost sales, and a negative impact on customer satisfaction.

By aligning S&OP with financial goals, companies can create a cohesive strategy that bridges the gap between day-to-day operations and long-term financial objectives. This alignment is essential for businesses aiming to thrive in competitive markets.

2. Key Strategies for Integrating S&OP with Financial Planning

To achieve a seamless integration between S&OP and financial planning, organizations must adopt several strategies that promote flexibility, collaboration, and streamlined processes.

Rolling Forecasts for Flexibility

Rolling forecasts are an essential tool for maintaining agility in a rapidly changing market environment. Unlike static annual budgets, rolling forecasts are updated regularly—typically monthly or quarterly—allowing organizations to adapt quickly to new information and changing conditions.

By continuously updating financial forecasts, businesses can better align their S&OP processes with real-time market demands. This approach ensures that inventory levels, production schedules, and marketing efforts are always in sync with the latest financial targets. For example, if sales projections are revised downward due to a sudden market shift, the rolling forecast will prompt the operations team to adjust production plans accordingly, thereby avoiding excess inventory and wasted resources.

Cross-Functional Collaboration for Alignment

Effective integration of S&OP with financial planning requires cross-functional collaboration. This means fostering a culture of communication and cooperation between finance, operations, sales, marketing, and other departments. When all stakeholders are involved in the planning process, it becomes easier to align operational activities with financial goals.

Best practices for fostering cross-functional collaboration include joint planning sessions, regular cross-departmental meetings, and the establishment of shared Key Performance Indicators (KPIs). For example, a joint planning session between finance and operations teams can help ensure that production schedules align with budget constraints, while regular meetings can keep all teams informed of any changes in demand forecasts or financial targets. Shared KPIs, such as inventory turnover rates or gross margin targets, can further reinforce alignment and drive collective accountability.

Integrated Software Tools for Streamlined Processes

Modern integrated software tools are indispensable for bridging the gap between S&OP and financial planning. These tools provide real-time data visibility, advanced analytics, and automation capabilities that enhance decision-making and streamline planning processes.

For example, software solutions that integrate financial data with supply chain management systems can automatically update forecasts based on actual sales, production, and inventory data. This real-time integration reduces manual errors, enhances data accuracy, and allows for quicker responses to market changes. Additionally, advanced analytics tools can help identify trends, forecast demand more accurately, and optimize inventory levels—all while keeping financial goals in mind. For a BlueYonder ecosystem, their S&OP solution is a good tool for managing the process. In other cases, companies can aggregate the data themselves through tools like Snowflake and Databricks with their own data pipelines.

3. Benefits of a Well-Integrated S&OP and Financial Planning Process

Integrating S&OP with financial planning brings numerous benefits to an organization:

- Improved Forecasting Accuracy: When S&OP and financial planning are aligned, forecasts are more accurate, leading to better budgeting and resource allocation. This reduces the risk of overproduction, stockouts, and financial shortfalls.

- Greater Agility: An integrated approach allows businesses to respond more quickly to market changes, whether they are shifts in demand, new competitive pressures, or supply chain disruptions. This agility helps maintain alignment between operational and financial goals.

- Enhanced Financial Performance: When operational activities are aligned with financial objectives, companies are more likely to achieve their revenue targets and maintain cost controls. This can lead to improved profitability and a stronger bottom line.

- Optimized Operational Efficiency: Integrated planning ensures that resources are used efficiently, reducing waste and improving productivity. This can lead to cost savings and a more sustainable business model.

4. Steps to Begin the Integration Process

To start integrating S&OP with financial planning, organizations can follow these practical steps:

- Assess Current Alignment: Evaluate the current state of alignment between S&OP and financial planning. Identify gaps where operational activities may not be supporting financial objectives, and determine areas for improvement.

- Invest in Integrated Planning Tools: Invest in software solutions that integrate financial data with operational planning. Look for tools that offer real-time data updates, advanced analytics, and automation capabilities to enhance the accuracy and efficiency of planning processes.

- Foster a Culture of Collaboration: Encourage cross-functional collaboration by establishing joint planning sessions, regular cross-departmental meetings, and shared KPIs. Make sure all relevant stakeholders are involved in the planning process to ensure alignment with financial goals.

- Regularly Review and Adjust Plans: Regularly review S&OP and financial plans to ensure they remain aligned with the organization’s strategic objectives. Adjust plans as needed to account for changes in market conditions, demand forecasts, or financial targets.

Conclusion

Integrating S&OP with financial planning is no longer a luxury—it is a necessity for businesses looking to succeed in today’s competitive environment. By aligning operational activities with financial goals, companies can achieve more predictable financial outcomes, enhance their agility, and drive greater overall business performance. We can help you start the integration process today, and unlock the full potential of your S&OP and financial planning efforts. Visit our other S&OP topics here for more information.

Explore More on S&OP Best Practices

- S&OP Process: A Comprehensive Guide – Dive into a detailed guide on building an effective S&OP process from start to finish.

- Integrating S&OP with Financial Planning: Aligning Goals – Understand the importance of aligning S&OP with financial planning to drive business success.

- Enhancing S&OP with CPFR: Collaborate for Better Outcomes – Explore how Collaborative Planning, Forecasting, and Replenishment (CPFR) enhances S&OP through supplier and customer collaboration.

- S&OP Maturity Models: Assess and Advance Your Process – Discover how to evaluate and enhance your S&OP process using maturity models.

- Scenario Planning in S&OP: Preparing for Market Uncertainties – Learn how scenario planning helps businesses anticipate market changes and manage risks.

- Change Management and S&OP: Implementing and Sustaining Success – Find out how to effectively implement and maintain S&OP through strategic change management.

- Choosing the Right Software Solution for Your S&OP Process – Evaluate the alternatives and make the best choice possible for your organization

- Custom build your S&OP Process with Microsoft Fabric – Instead of using a third party tool, custom build your S&OP process with a data pipeline