Online Grocery Shopping Channel Analysis

Here are some more insights we found in our analysis of online shopping behavior and tests:

- Targeted email and direct mail campaigns were most effective. By analyzing prior purchases, you can for example determine if a customer prefers meat, poultry, fish or vegetarian. By targeting correspondence and promotions at a macro level, the engagement rate was significantly higher than generic promotions for protein.

- A significant number of customers arrived at the grocer’s site through organic searches. Many of the organic searches are for broad categories like “fresh fruit online” or “fresh fish”. This ultimately led to a search link on the site with little to no merchandising, so new customers didn’t understand their value prop. In one experiment, we prominently displayed value messages in search results which we expected to have a higher conversion rate with new customers.

- New customers tend to browse the site categories, navigating through headers and surveying the assortment whereas existing customers tend to simply search for the items they want. This leads to more opportunities to merchandize to new customers but if you try to merchandize too much to existing customers it simply slows the experience down and they buy less.

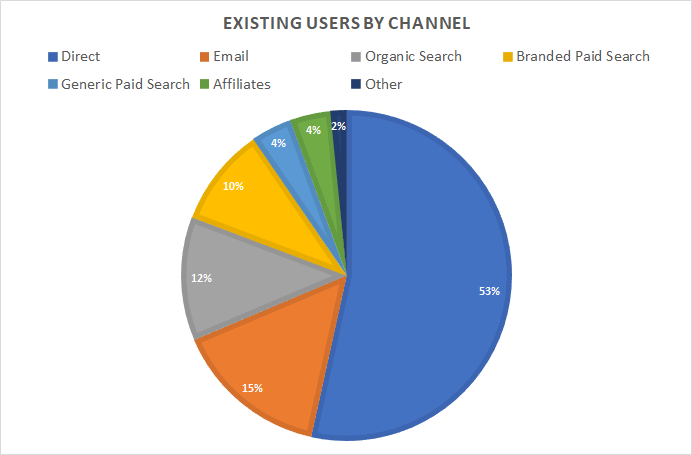

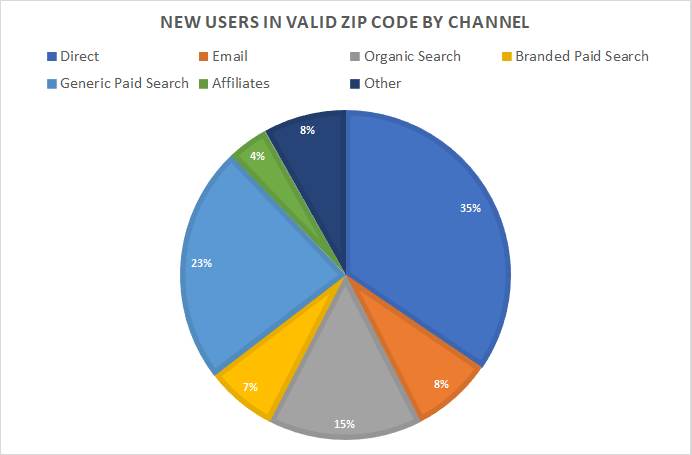

Building on the previous post analysis, we utilized Google Analytics to understand where the customers were coming from and their conversion rates for each acquisition path. Using our insight from the previous analysis we again segmented the customers into existing users and new users from valid zip codes.

Here you can see that the majority of customers were arriving at the site direct. For existing customers, the users would go directly to the URL or click on a link in their history such as the cart page. A significant number of customers arrived from Organic Search. Again, a significant number of existing customers would simply use Google search to find the site rather than clicking on their browser history. A significant number of new users would also enter the retailers name in search and we suspected that the brand awareness came from marketing activity such as billboards, direct mail, and other advertising.

| Channel | Type | Users (K) | Bounce Rate | Conversion Rate |

|---|---|---|---|---|

| Direct | E | 415 | 16.12% | 24.35% |

| N | 589 | 43% | 10.75% | |

| E | 105 | 29.32% | 12.13% | |

| N | 90 | 53.45% | 5.27% | |

| Organic Search | E | 81 | 14.03% | 24.34% |

| N | 258 | 36.67% | 10.68% | |

| Branded Paid Search | E | 61 | 12.99% | 22.58% |

| N | 103 | 21.28% | 13.85% | |

| Generic Paid Search | E | 37 | 42.86% | 9.98% |

| N | 398 | 81.64% | 0.89% | |

| Affiliates | E | 36 | 13.64% | 26.83% |

| N | 45 | 36.20% | 12.93% |

The glaring issue in this analysis was that Generic Paid Search was performing abysmally for new customers but had a significant number of sessions.

Further analysis on the Generic Paid Search found that customers were searching for individual items and would then abandon the site. Our next step was to survey these customers to try and understand what the customers were looking for. Using Qualtrics we could solicit the customers for feedback by offering a credit on their next purchase. By doing that, customers that had no intention of buying would consider buying now that they were invested and had a credit.

K3Group can work with you to fine tune your strategy. Again, we’ll send more insights in our next cadence and if you’d like to learn more about any of this, we’d be happy to share the information on a call.

Explore More on Online Grocery Shopping Insights

- Grocery Item Search Suggestions – Learn how to enhance user experience with smart search suggestions in online grocery.

- Dynamic Assortments in Online Grocery Shopping – Discover the benefits of tailoring product assortments to meet shopper preferences.

- Building a Grocery Cart Faster – Explore strategies to streamline the cart-building process for faster, more convenient shopping.

- Online Grocery Shopping Channel Analysis – Analyze key trends and performance across different online grocery channels.

- Insights on Grocery Online Shopping Behavior – Gain insights into consumer behavior to inform your online grocery strategy.